Trying Something New? Don’t Miss Out on R&D Tax Credits for Manufacturing

Many manufacturers are eligible, but only 1 in 20 claim the research and development tax credit. You may be surprised about what qualifies.

If you’re “taking a chance” or “trying something new” with a manufacturing process or product, don’t miss out on the research and development (R&D) tax credit. Many manufacturers are eligible, but only one in 20 claim it.

The R&D tax credit could offset income tax expenses related to innovations, such as:

- automating a paint line with robotics

- going from manual to automated spraying methods

- designing or redesigning an assembly line

- using a pump or dispense system in a different way

Contact your company’s tax department or tax analyst about projects that could qualify as research and development. You may be pleasantly surprised.

What are R&D tax credit qualified expenses?

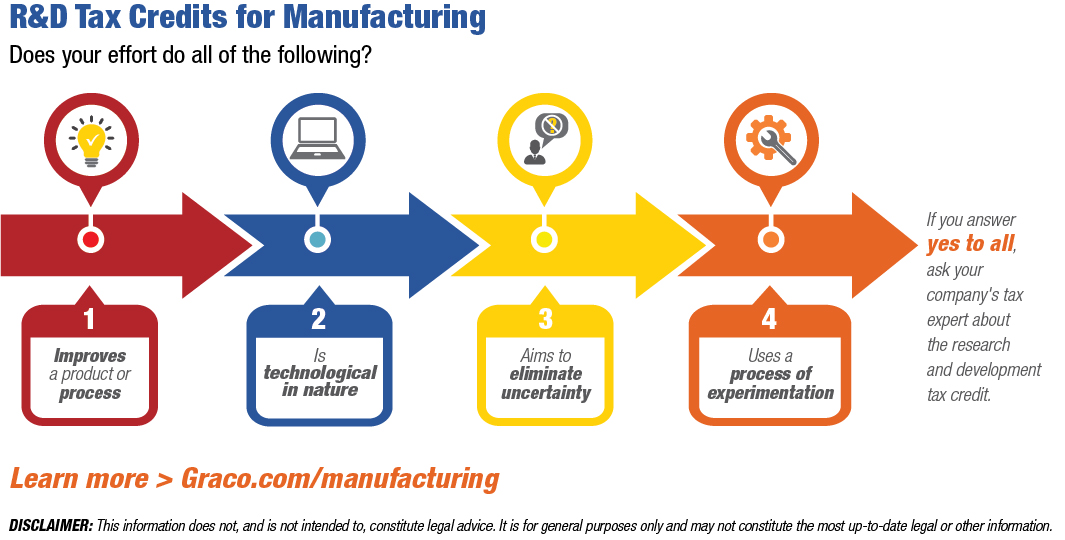

Look into the research and development (R&D) tax credit if an activity or project meets these four requirements:

- Improves function, performance, reliability and quality of product or process.

- Is technological in nature, relying on engineering, physical science, biological science, or computer science.

- Aims to eliminate uncertainty about product or process improvement, or appropriateness of a design.

- Experiments with or evaluates alternatives through trial and error, testing, and/or modeling.

Even if a project fails, it’s still likely research and development. The R&D tax credit could still offset income tax costs.

What expenses can be claimed for manufacturing R&D tax credit?

Claimable expenses involve wages, supplies and contract research. Examples include:

- salary paid to employed engineers who designed the improvement

- hourly wages paid to linemen who built prototypes

- supplies used to model or test the innovation

- payments made to researchers hired on a contract basis

Who offers the tax credit?

The United States federal government started offering the research and development tax credit in 1981. The Protecting Americans from Tax Hikes (PATH) Act of 2015 made it a permanent part of the federal tax code.

Many states also offer a research and development tax credit. Companies in those states can claim both state and federal tax credits.

_______________

Knarr, Greg. How a Little-Known Tax Credit Can Pay Off Big in Automation Costs. IndustryWeek, alliantgroup, 20 July 2018

Holtzman, Yair. U.S. Research and Development Tax Credit. The CPA Journal, New York State Society of CPAs, 25 Oct. 2017

Echols, Mark. Why Manufacturing Companies Are Missing Out On Valuable R&D Credits, Tax Incentives Blog, Corporate Tax Incentives, 4 Apr. 2018

_______________

DISCLAIMER: The information provided on this website does not, and is not intended to, constitute legal advice. Instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date legal or other information.

Free Webinar

The Quest for Paint Line Automation

This 38-minute webinar equips you with ways make the case for automation and real-life examples of how manufacturers automate some of all of their paint lines.